I think that my best course of action is to avoid malls in general. I'm not going to lie though, I do take a little peak online to see what's out there but I haven't purchased any clothes, purses, accessories or shoes yet! Go me!

One thing I did find was rain boots.I ordered them off of the Target website and they should arrive here very shortly. I spent $7.50 on them. Target is one of those hit or miss places. I have some items from there that I love but some of their items aren't that great of quality. I thought about how much I wanted to spend on rain boots, and I figured that it was pointless to spend a lot of money on them. Mainly because I wouldn't wear them that often. I just need something to keep my feet dry during the few rainy days that we have in the D.C. area.

Oh by the way, making it passed the Memorial Day Weekend with all the sales wasn't too bad. But it's only been a week.... let's see what I'm saying in 3 months!

Frugalista

Wednesday, May 30, 2012

Wednesday, May 23, 2012

Day 1.. What Was I Thinking?!

So it's been one day since I've taken on this challenge. I am proud to say that I haven't purchased anything! Haha. There are many temptations though. In my previous blog post, I wrote how I have a special email account to receive sales alert. I've decided to keep the account but I will just go in and delete everything without seeing the content of the emails. This way, there are no temptations.

On another note, some of the blogs that I follow are saying that the Nordstrom is having their Half-Yearly Sale and J.Crew is having an additional 30% off of their sale items. This is how I feel right now...

Gotta stay strong!

On another note, some of the blogs that I follow are saying that the Nordstrom is having their Half-Yearly Sale and J.Crew is having an additional 30% off of their sale items. This is how I feel right now...

Gotta stay strong!

Tuesday, May 22, 2012

Taking on a Challenge

I would like to apologize for the delay in my posts. It's been months since my last post because I've been thinking about what I want to do with my blog. I wanted to think more of a direction that I wanted to take it.

I've been reading a lot of articles on LearnVest.com and I've come to an interesting thought. I love clothes, shoes and purses like any women. But how necessary is some of my purchases? I'm a frugal shopper and I try to find bargains whenever I can. But just because something is cheap, doesn't mean that it's a good deal. So I think I'm going to take a drastic step in my life....

1.) Clean out my closet!

I have a simple rule, if I haven't worn it for 2 years, it goes to charity. This is primarily due to the fact that I could have worn my article of clothing for 2 seasons and I didn't. For whatever reason, I didn't wear it. And off it goes to charity!

I'm also going to get rid of all items that I would not want my ex to see me in. Ladies, let's admit it. We all have clothes that we shouldn't be in possession of. I'm either going to donate the clothes or throw them away depending on the condition of the item.

Goal: Downsize and Simplify!

2.) Stop Shopping

That's right. You read that right. I am going to make a plan to stop buying clothes for 3 months. It will be only for 3 months but my goal is try to last longer. I'm taking baby steps here. This includes, shoes, accessories, purses (Eek!) and anything that would be considered a clothing item. My head is feeling light headed just thinking about this. But I strongly believe that I can do it.

I'm sure, you guys are scratching your heads trying to figure out why I'm doing this. I have two reasons.. one, I think that my purchases are unnecessary at times. My shopping budget per month is reasonable but I do buy things that I want and not need. My second reason is so that I can save a little bit extra for our first home that we plan to purchase at the end of this year. Ideally, I would like to not shop until December.

Goal: Wear what I own because I have more than enough clothes

3.) Write About My Journey of not Spending Money

I'm going to share to you guys about my journey... you know the struggles, the withdrawals etc.

Goal: Hopefully I will be able to motivate you

So starting today on May 22, 2012... I will stop shopping!

Note: The only purchase that I plan to make in the next 3 months are rain boots! I walk and take a train to get to work and on those rainy days, a rain boot would be must appreciated. I've been looking for months but I haven't been able to find rain boots that I want. This will be my one and only purchase.

Readers: What do you think?

I've been reading a lot of articles on LearnVest.com and I've come to an interesting thought. I love clothes, shoes and purses like any women. But how necessary is some of my purchases? I'm a frugal shopper and I try to find bargains whenever I can. But just because something is cheap, doesn't mean that it's a good deal. So I think I'm going to take a drastic step in my life....

1.) Clean out my closet!

I have a simple rule, if I haven't worn it for 2 years, it goes to charity. This is primarily due to the fact that I could have worn my article of clothing for 2 seasons and I didn't. For whatever reason, I didn't wear it. And off it goes to charity!

I'm also going to get rid of all items that I would not want my ex to see me in. Ladies, let's admit it. We all have clothes that we shouldn't be in possession of. I'm either going to donate the clothes or throw them away depending on the condition of the item.

Goal: Downsize and Simplify!

2.) Stop Shopping

That's right. You read that right. I am going to make a plan to stop buying clothes for 3 months. It will be only for 3 months but my goal is try to last longer. I'm taking baby steps here. This includes, shoes, accessories, purses (Eek!) and anything that would be considered a clothing item. My head is feeling light headed just thinking about this. But I strongly believe that I can do it.

I'm sure, you guys are scratching your heads trying to figure out why I'm doing this. I have two reasons.. one, I think that my purchases are unnecessary at times. My shopping budget per month is reasonable but I do buy things that I want and not need. My second reason is so that I can save a little bit extra for our first home that we plan to purchase at the end of this year. Ideally, I would like to not shop until December.

Goal: Wear what I own because I have more than enough clothes

3.) Write About My Journey of not Spending Money

I'm going to share to you guys about my journey... you know the struggles, the withdrawals etc.

Goal: Hopefully I will be able to motivate you

So starting today on May 22, 2012... I will stop shopping!

Note: The only purchase that I plan to make in the next 3 months are rain boots! I walk and take a train to get to work and on those rainy days, a rain boot would be must appreciated. I've been looking for months but I haven't been able to find rain boots that I want. This will be my one and only purchase.

Readers: What do you think?

Wednesday, January 11, 2012

Ann Taylor Semi-Annual Sale

Ann Taylor is currently having their semi-annual sale right now! Everything is currently 40% off. As a frugal shopper, I LOVE this time of the year. I'll travel to different stores just to see their different selection.

My current frugal find is this beautiful white winter coat that I have been admiring for awhile.

This is the Belle Coat. Originally priced at $398. Currently online for $199.

At store is is $99.88 PLUS an additional 40% off. Making this coat $59.93!!!

Readers: Have you found any great deals during Ann Taylor's semi-annual sale?

My current frugal find is this beautiful white winter coat that I have been admiring for awhile.

This is the Belle Coat. Originally priced at $398. Currently online for $199.

At store is is $99.88 PLUS an additional 40% off. Making this coat $59.93!!!

Readers: Have you found any great deals during Ann Taylor's semi-annual sale?

Wednesday, December 28, 2011

The Joys of Budgeting

Budgeting is HARD.

It's easy to sit down and create a budget on how much you are going to spend per month in each category but it is extremely difficult to stick to your budget. I will admit that I still have difficulty staying on track.

Here are some common questions when it comes to budgeting:

1.) Do I have to stick to the exact numbers?

No. Your budget should be viewed as a guideline. Let's say for example, that you spent all of your food/grocery money by the 28th of the month and there is literally nothing to eat at your house. Do you starve yourself until the beginning of the next month? Obviously not. If you already reached your food/grocery budget for the month it's okay to go get more food. BUT it should only be for groceries and not for meals for dining out.

2.) Can my budget change every couple of months?

Of course. Life brings on many exciting changes and you need to be able to be flexible to accomodate the neccessary changes.

I have a perfect real life scenerio. A year ago, I started my first "big girl" job. I try to be careful when I purchase clothes for work and try to select items that can be used for mutliple seasons. However, living in the D.C. area, the winters can get very cold. The only winter coat that I had was a fun sporty coat that I used in college. Even though the coat kept me warm during my wonderful college years, I didn't view it as professional looking. So in order to brace myself for the winter season, I invested in a high quality expensive coat that exceeded my shopping budget for the month. However, I viewed this as a neccessary purchase. I believe that it is important to be frugal but you need to know how/when to spend your money. I could have gone to Forever 21 and purchased a cheap winter coat. But it wouldn't have kept me warm nor would it have lasted between seasons. I ended up buying a Calvin Klien peacoat but I know that I will be wearing it for many years to come.

Budgeting does have it's limitations. You might not be able to purchase a new purse every single month but I think it's a fabulous idea to treat yourself every once in awhile. It could be something small as coffee from starbucks or something bigger like a mani/pedi. How you treat yourself is up to you. But where does the money come from? It can be from your savings category or shopping category or whatever you feel would be appropriate

Readers: What is your biggest challenge when it comes to budgeting?

Friday, December 23, 2011

Budgeting 101

Sorry about the lack of posts. The hubby and I decided to move and it's been hectic for us.

One of the best things that you can do for yourselves is to create a budget. A wonderful source that I highly recommend is Mint.com. It's a highly secure site that you can use to track your spending.

The big question that many of us have is.. how much should I put into each category when I budget myself? I don't think there is an exact answer but there are guidelines that we should follow and keep in mind when we are creating a budget.

After doing some research, I discovered that different sources recommend different budgeting methods. I took it upon myself to tweak what I found to fit into my life style.

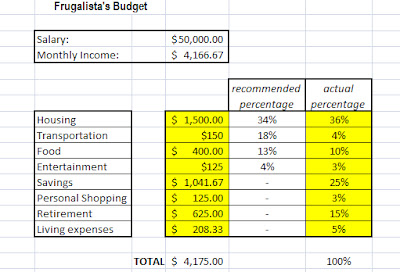

Here is what I found... I'm basing all of these numbers off of a $50,000 salary and your budget should be created before taxes.

So let me explain what is going on in my spreadsheet. Based on a $50,000 salary, I would be making $4,166.67 per month BEFORE taxes.

-Housing: They recommend that you spend between 35%-45% on housing expenses. This will vary based on your living situation and where you live. In my housing expense, I include the water, electric and cable bills. Since for the most part, they are fixed

-Transportation: Budgeting website recommend that you put 18% in this budget. I live in the DC area and I use public transportation to get around. So my monthly transportation cost is lower than most peoples.

-Food: They say that you should budget about 13% towards food. I put 10% towards food. This includes groceries, going out to eat, and carry out food. Before I started budgeting myself, this was my biggest pitfall. I spent WAY too much money on going out to eat. Now I pack my food to take to work with me. It has saved me tons of money.

-Savings: I strictly try to save 25% per month. There are times I save more, but 25% is my bare minimum.

-Personal Shopping: I allocated 3% of my budget towards shopping for clothes, purses, make up, or anything else that is for my personal needs. I try my best to stay within this budget. For example, I have spent $0 on myself. But who knows with the after Christmas sales.....

-Retirement: You are never too young to start saving up for your retirement. If your work has a 401k account, utilize it! I put 15% of my paycheck just towards my retirement. I want to be able to enjoy my time off when I retire

-Living expenses: Life happens and there are times when you have to pay for something that is unexpected. That's why I have a living expense budget. I put 5% of my paycheck towards it and it rolls over every single month. If nothing happens for 7 months, the amount accumulates. If something happens in month 8, I use my living expenses budget to help cover the amount.

These budgets are based off of my life style. Other people's could vary.

I'll post some more follow up budgeting posts in the next couple of days. Stay tuned!

Readers: How do you budget yourself?

One of the best things that you can do for yourselves is to create a budget. A wonderful source that I highly recommend is Mint.com. It's a highly secure site that you can use to track your spending.

The big question that many of us have is.. how much should I put into each category when I budget myself? I don't think there is an exact answer but there are guidelines that we should follow and keep in mind when we are creating a budget.

After doing some research, I discovered that different sources recommend different budgeting methods. I took it upon myself to tweak what I found to fit into my life style.

Here is what I found... I'm basing all of these numbers off of a $50,000 salary and your budget should be created before taxes.

So let me explain what is going on in my spreadsheet. Based on a $50,000 salary, I would be making $4,166.67 per month BEFORE taxes.

-Housing: They recommend that you spend between 35%-45% on housing expenses. This will vary based on your living situation and where you live. In my housing expense, I include the water, electric and cable bills. Since for the most part, they are fixed

-Transportation: Budgeting website recommend that you put 18% in this budget. I live in the DC area and I use public transportation to get around. So my monthly transportation cost is lower than most peoples.

-Food: They say that you should budget about 13% towards food. I put 10% towards food. This includes groceries, going out to eat, and carry out food. Before I started budgeting myself, this was my biggest pitfall. I spent WAY too much money on going out to eat. Now I pack my food to take to work with me. It has saved me tons of money.

-Savings: I strictly try to save 25% per month. There are times I save more, but 25% is my bare minimum.

-Personal Shopping: I allocated 3% of my budget towards shopping for clothes, purses, make up, or anything else that is for my personal needs. I try my best to stay within this budget. For example, I have spent $0 on myself. But who knows with the after Christmas sales.....

-Retirement: You are never too young to start saving up for your retirement. If your work has a 401k account, utilize it! I put 15% of my paycheck just towards my retirement. I want to be able to enjoy my time off when I retire

-Living expenses: Life happens and there are times when you have to pay for something that is unexpected. That's why I have a living expense budget. I put 5% of my paycheck towards it and it rolls over every single month. If nothing happens for 7 months, the amount accumulates. If something happens in month 8, I use my living expenses budget to help cover the amount.

These budgets are based off of my life style. Other people's could vary.

I'll post some more follow up budgeting posts in the next couple of days. Stay tuned!

Readers: How do you budget yourself?

Monday, December 12, 2011

Love for designer bags

I am a 25 year old female who loves Coach purses. They are beautiful, classic and well expensive.

Coach factory stores are becoming ever so popular. More stores are being built and many people go find a bargain. So many people wonder, what's the difference between a Coach store and a Coach factory store?

Well to begin with Coach factory stores are located at outlet malls. While Coach stores are at regular malls. Coach factory stores usually have a mix of coach factory products and last season's coach store products. How do you spot the difference?

Look inside the bag. All coach purses should have a "credo patch". There should be a serial number inside of the bag. However, smaller purses such as clutches or crossbodies do not have one. Look at the serial number. If it starts with a "F", it is made just for the factory.

Just because it is made just for the Coach factory does not mean it is a fake purse or of lower quality. From my experience, there is just as good quality but less details.

I usually go to the back of the store and store in their sale selection to find the Coach purses that are from last season. The best way to become educated about Coach purses is by looking at their website. Become familiar with their current style and patch work.

Coach sometimes have a 25% off sales at their full price stores from time to time for their valued customers. These coupons are received through the mail. Right now, if you "like" the Coach Facebook page, you can score a 25% off coupon.

While Coach outlet stores offers 20% or 30% off the lowest price to all of their customers. They usually pass out these coupons at the front door of the store.

I recently found an amazing deal at the Coach factory store. There was a purse that I saw on their website that I have been craving for the last couple of months. It is listed at $199

Ladies: This is the Kristen Signature Sateen Hippie

Gorgeous purse but a bit out of my price range. With Coach's 25% off coupon, this purse would be $149.25. Not TOO bad..

BUT!

I found this exact same purse at the Coach factory stores. $199 then 40% off then an additional 30% off!! Final cost: $83.58! Wahoo! This gorgeous beauty is now mine :) I have given her an excellent home

Readers: Do you have any amazing finds at the Coach factory stores?

Subscribe to:

Comments (Atom)