Sorry about the lack of posts. The hubby and I decided to move and it's been hectic for us.

One of the best things that you can do for yourselves is to create a budget. A wonderful source that I highly recommend is Mint.com. It's a highly secure site that you can use to track your spending.

The big question that many of us have is.. how much should I put into each category when I budget myself? I don't think there is an exact answer but there are guidelines that we should follow and keep in mind when we are creating a budget.

After doing some research, I discovered that different sources recommend different budgeting methods. I took it upon myself to tweak what I found to fit into my life style.

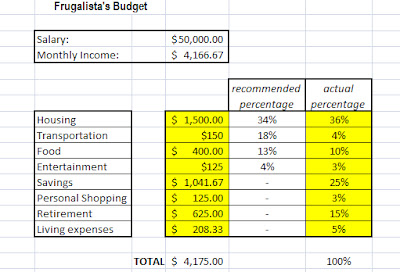

Here is what I found... I'm basing all of these numbers off of a $50,000 salary and your budget should be created before taxes.

So let me explain what is going on in my spreadsheet. Based on a $50,000 salary, I would be making $4,166.67 per month BEFORE taxes.

-Housing: They recommend that you spend between 35%-45% on housing expenses. This will vary based on your living situation and where you live. In my housing expense, I include the water, electric and cable bills. Since for the most part, they are fixed

-Transportation: Budgeting website recommend that you put 18% in this budget. I live in the DC area and I use public transportation to get around. So my monthly transportation cost is lower than most peoples.

-Food: They say that you should budget about 13% towards food. I put 10% towards food. This includes groceries, going out to eat, and carry out food. Before I started budgeting myself, this was my biggest pitfall. I spent WAY too much money on going out to eat. Now I pack my food to take to work with me. It has saved me tons of money.

-Savings: I strictly try to save 25% per month. There are times I save more, but 25% is my bare minimum.

-Personal Shopping: I allocated 3% of my budget towards shopping for clothes, purses, make up, or anything else that is for my personal needs. I try my best to stay within this budget. For example, I have spent $0 on myself. But who knows with the after Christmas sales.....

-Retirement: You are never too young to start saving up for your retirement. If your work has a 401k account, utilize it! I put 15% of my paycheck just towards my retirement. I want to be able to enjoy my time off when I retire

-Living expenses: Life happens and there are times when you have to pay for something that is unexpected. That's why I have a living expense budget. I put 5% of my paycheck towards it and it rolls over every single month. If nothing happens for 7 months, the amount accumulates. If something happens in month 8, I use my living expenses budget to help cover the amount.

These budgets are based off of my life style. Other people's could vary.

I'll post some more follow up budgeting posts in the next couple of days. Stay tuned!

Readers: How do you budget yourself?

useful guide! will take some of your ideas into account for my budgeting. currently I use the template laid out from a book "Smart Women Finish Rich" by former financial advisor David Bach. The book was given to me by an aunt as a guide to life skills. wondering if i should start reading Suze Orman also... :)

ReplyDeleteHi Julien,

ReplyDeleteI plan to post some more budgeting tips in the next couple of days so please check back :) I think I might go on amazon and order myself a Suze Orman book. I always found her fascinating on her television show